An uninteresting room with dull colours. Papers scattered everywhere. Michael Burry lying on his back, staring at the ceiling.

In 2015, this became the image of conviction. Burry bet against housing and won, then went quiet for two years. In October 2025, he came back and shorted Nvidia and Palantir with $9.2 million. After Nvidia posted blowout earnings, he wrote: "Just because something is used does not mean it is profitable." Then he closed his hedge fund because his views were out of sync with the markets.

His argument is straightforward. Hyperscalers depreciate AI chips over five to six years when they become obsolete in two to three years, inflating earnings by roughly $176 billion through 2028. Peter Thiel, SoftBank, and Berkshire Hathaway have quietly repositioned.

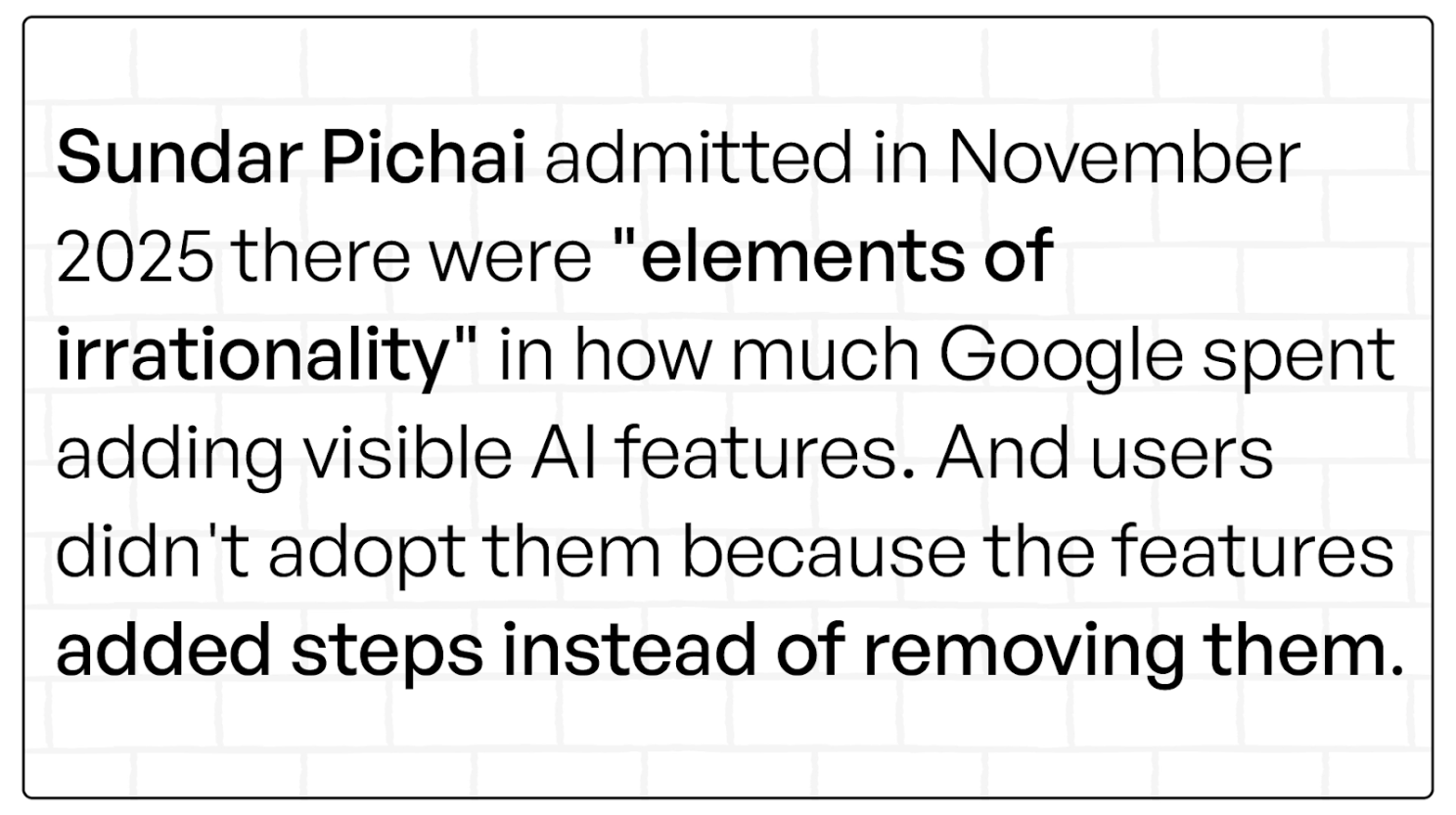

Whether Burry is right about the financial bubble or not, there's a product strategy signal underneath that matters more. When boards saw AI infrastructure spend as the strategy, product teams responded by shipping visible AI features to justify that spend instead of redesigning workflows end-to-end.

95% of enterprise AI pilots fail, and AI startup funding just hit a nine-year low in deal volume. VC behavior suggests they're already shifting toward outcome-first bets. The money is still flowing (about $64 billion in Q3 2025), but it went to 2,427 deals instead of 2,987. Investors are writing bigger checks to fewer companies, and the ones getting funded aren't promoting their AI capabilities, they're showing measurable outcomes.

For instance, logistics companies don't want "AI route optimization powered by GPT-6" as a selling point, they want trucks arriving 20% faster with no extra work. The AI should be invisible infrastructure, not something they have to manage or think about. That gap between what companies built and what users needed is where the real bubble lives.

Three structural shifts are happening right now that matter more than bubble speculation. Miss these and you'll keep competing on features in a market that stopped caring about features.

The first shift is about subtraction, not addition

The most valuable innovation is removing friction by reducing clicks, eliminating decisions, and making interfaces disappear. An HR platform used to have a twelve-step onboarding workflow and now has one interaction where the user types a name. The AI pulls data from multiple sources, generates the profile, sends documents, and triggers notifications.

The second shift is about who gets to build

Users are becoming co-creators because they can now shape workflows, generate reports, build automations, and redesign interfaces without code. A financial services platform used to require dev tickets for custom reports. Now analysts create their own dashboards, define their own metrics, and automate workflows using natural language.

The third shift is about making technology invisible

The highest-value SaaS products hide their AI completely because when users see the technology working, that visibility usually means it's adding friction. A customer support tool used to display an "AI assistant" button, and now there's no button, no badge, no label. A user asks a question and the answer surfaces.

At this point, it helps to stop thinking in features and start thinking in pressure. Where is your product overbuilt, underused, or mispriced?

I use a simple tool called the AI Product Pressure Gauge with four bands. Each band measures a different dimension of product-market fit in an AI-first world. You rate where you are today on each gauge (0-100%), then use the questions underneath to figure out what needs to shift.

The four bands are:

Each band has a left-to-right scale and 2-3 sharp questions that help you diagnose where you're stuck. The ones scoring closest to 0% (furthest left) are your highest-priority fixes. Pick one, answer the questions, and run one experiment to move that gauge 10-20% to the right this quarter.

[Download the full AI Product Pressure Gauge]

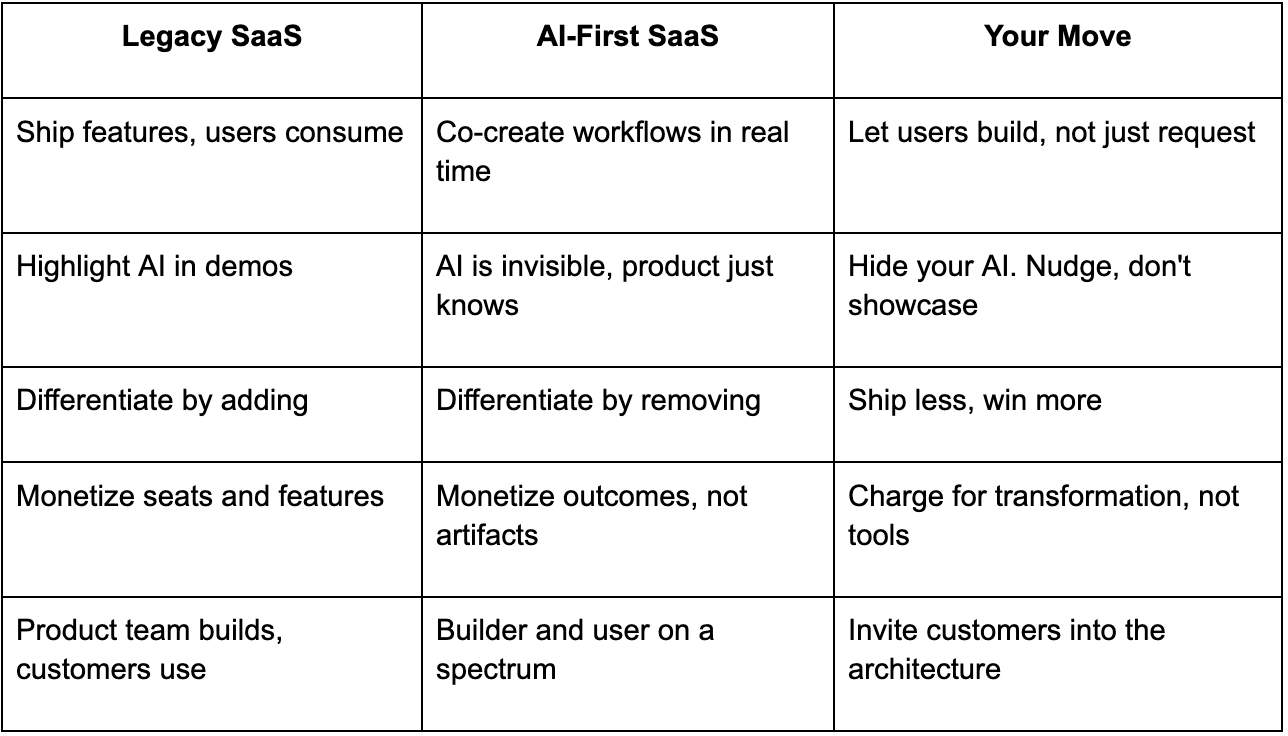

When product architecture shifts, everything downstream shifts with it. The old approach was packaging features into tiers, selling seats, monetizing usage, and maintaining a boundary between builder and user. That made sense when products were fixed and users were consumers.

The new approach means selling access to transformation zones where users build and change things themselves, pricing based on outcomes achieved instead of feature usage, and packaging around co-creation capability. Your go-to-market becomes teaching customers to erase friction, even when that means deleting your own modules or simplifying your UI.

This explains why legacy SaaS companies are struggling, because they're selling feature bundles when the market wants outcome guarantees.

Burry is betting against the accounting tricks. I'm watching the companies that figured out the reset button.

Whether the financial bubble bursts in 2026 or later, the product strategy shift is already here.

Think of GenAI as the backspace key for your industry's interface. The question is whether you're using it to delete friction or just adding more buttons.