TL;DR

Let us tell you about the day Ramesh almost got fired.

Ramesh runs trade marketing for a building materials company in Pune. Six months ago, his CEO called him into the corner office, pointed at a competitor's billboard, and said, "They've got a loyalty program with 50,000 members. Where's ours?"

Thirty days and ₹1.2 crores later, Ramesh launched a cashback program. The dashboard looked beautiful, 32,000 members enrolled in the first week. He presented the numbers in the boardroom, everyone clapped and the CEO called it a success.

But here is what Ramesh knew and could not say in that meeting.

His field salesman Rajesh called him the next morning. "Boss, the electricians are deleting the app. They say it takes 15 minutes to register and the points do not post for 10 days."

His channel manager sent WhatsApp screenshots, dealers were confused about the redemption catalogue, the app crashed on low end Android phones, which is what 70% of mechanics use.

By month 3, weekly active engagement was 18%. The CFO started asking questions. Ramesh had 32,000 names on a database but only 5,700 people were actually using the program, he was spending ₹2 crores on a ghost town.

P.S. This scenario is based on common challenges we've observed across dozens of loyalty program audits.

This is the story playing out in manufacturing companies across India, the Middle East, Southeast Asia, and Africa. 77% of cashback loyalty programs fail within two years because points without purpose create zero switching costs. A competitor offers ₹1 more, and your "loyal" electrician walks away.

The problem is the gap between what you think is happening and what is actually happening on the ground.

The Loyalty Activation Framework closes that gap.

Most loyalty programs are built in boardrooms by people who have never spent a day on a job site. They optimize for quarterly revenue goals and dashboard metrics. They treat partners like transaction processors instead of professionals.

This disconnect creates what Pangolin Marketing calls the Loyalty Gap: the massive space between what leadership believes is happening and what trade partners actually experience.

Trade partners live in a different world than the one described in strategy decks.

An electrician manages five to six job sites daily. His phone battery hits 2 percent by noon, the site WiFi barely works, and there is no quiet corner to fill out long forms. He trusts dealer recommendations and WhatsApp messages from peers far more than apps. He needs instant gratification, WhatsApp first communication, and proof from someone he trusts that your program delivers real value.

A painter works from 7 a.m. to 6 p.m. with limited digital literacy and follows contractor instructions because he cannot afford friction. He needs visible status symbols, immediate cash rewards, skill training, and vernacular interfaces.

A mechanic handles ten to fifteen jobs daily with razor thin margins and serves as a trusted advisor who cannot recommend junk for points. He needs confidence in genuine parts, technical training, and family health benefits that protect his livelihood.

A small retailer keeps his shop open twelve hours daily serving fifty to one hundred customers while juggling multiple brands. Working capital stress means he cares about margin support and credit flexibility, not points he cannot redeem for sixty days.

These are not abstract personas. These are real people with real constraints, motivations, and skepticism born from years of failed schemes. When they encounter your loyalty program, they are exhausted, distracted, and suspicious.

Most loyalty conversations stay at the level of "How many members do we have?" and "What is our NPS this quarter?" That is not enough. Senior leaders need a way to see where the program is leaking, why it is leaking, and what to change next.

The Ground Truth Framework is that tool. It breaks a partner's journey into six clear stages and looks at each stage through four different lenses. Together, they turn a vague "engagement problem" into a concrete map of where reality diverges from the boardroom story, and what to do about it.

This is your version of a McKinsey or BCG framework. Simple on the surface. Very sharp underneath.

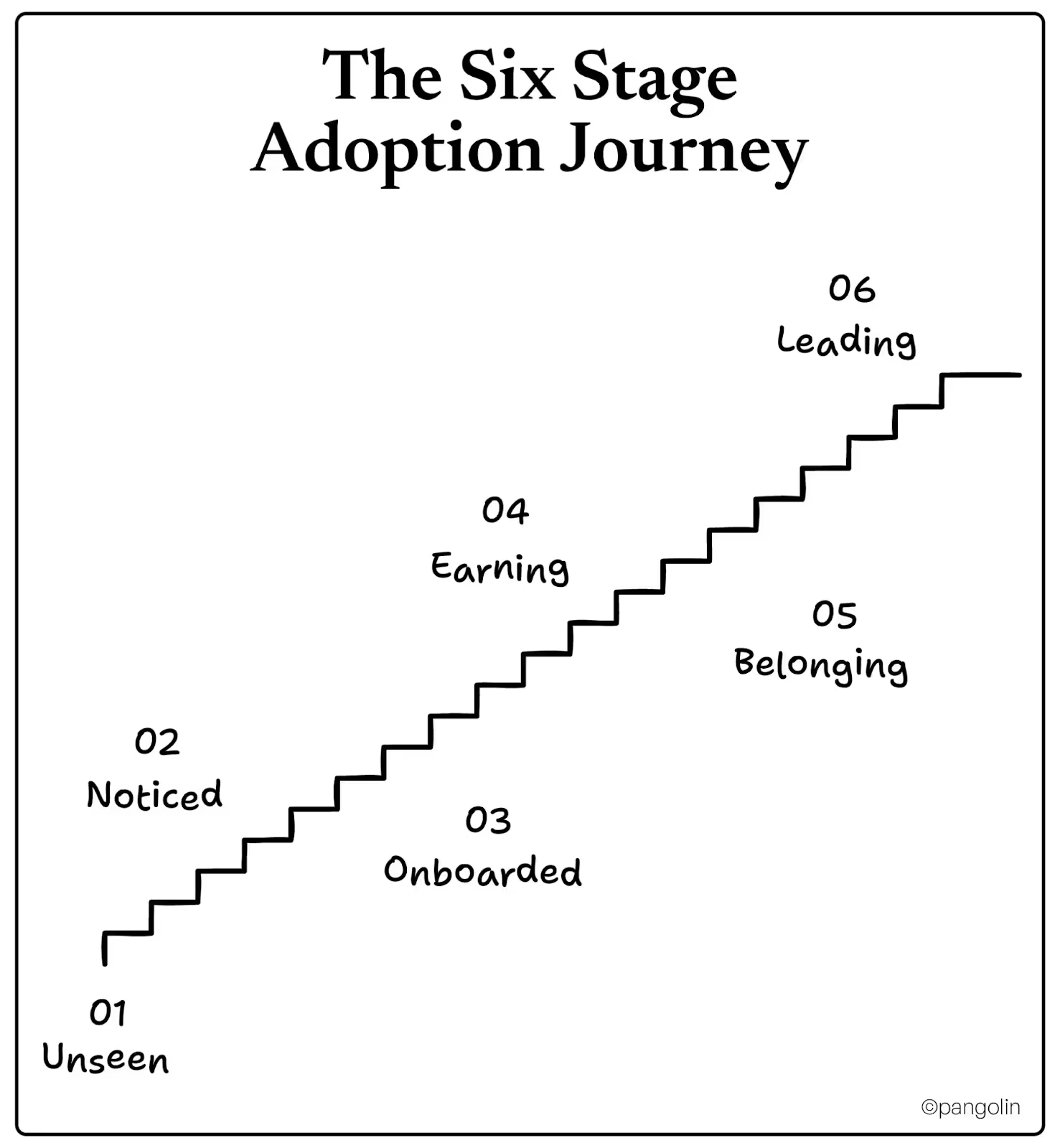

Think of a trade partner's journey as a pipeline, from never having heard of you to leading your community. The loyalty activation framework defines six stages along that path.

At this point, the trade influencer has never really heard of the program. They might have seen a logo on a poster at a dealer's counter, but it is in the same mental box as a lot of other plans. There is no trust, no understanding, and no reason to care. A lot of your target market stays in this stage for months after launch in fragmented markets.

The partner has heard "points milte hain" from a dealer, WhatsApp forward, or fellow electrician, but they can't explain how it helps in one sentence. They might say, "There's an app that scans bills and gives you something," but they don't know how it works, when the rewards will come, or why this program is better than the other ten they've seen. People are aware, but they are very skeptical. Curiosity isn't strong enough to get rid of the friction yet.

At this point, the partner has officially joined. You have finished KYC, installed the app, and their name is now on your dashboard. But there is no habit. They don't know what to do next. They don't know what to do after they sign up, when they'll get their first reward, or what will happen if something goes wrong. A lot of leadership teams stop looking here. Enrollment rises, slides look good, and the real problem stays hidden. If you don't have a first win, onboarding is just an illusion of progress.

The partner has begun to use the program on a regular basis. They scan bills, enter codes, or claim rewards often enough that they can guess what will happen. They know that "If I do X, I get Y," and they have seen that promise come true. But they still think of it as a business deal. It's not a reason to be loyal; it's just a way to make some extra money. Competitors can still lure them away with better credit terms, higher cashback, or an easier app.

At this point, something big happens. The partner begins to think of the program as a part of who they are. Badges, levels, learning paths, and community experiences show that they are part of a group, not just a database. An electrician is proud to be a pro tier. At the workshop, a mechanic talks about "our brand." A painter hangs his certificate on the wall of the shop. Family benefits, recognition events, and learning journeys make the relationship feel real instead of like a machine. This is where emotional loyalty starts to guide behavior.

The partner is no longer just engaged in the last stage. They are actively changing the results. They send their friends to stores, help retailers decide what to stock, confidently push new SKUs, and work together to make content, ideas, or feedback. The program is now more than just a reward system; it's also a business tool and a place for people to connect. At this point, partners act like a bigger sales and advocacy team.

The power of the loyalty activation framework comes from looking at every stage through four different perspectives. This is where "we have an engagement problem" turns into "we lose electricians between Noticed and Onboarded because KYC takes 15 minutes and the app fails on low-end Android phones."

Here's how it works:

Lens 1: Partner Reality

What is the trade partner actually experiencing at this stage?

Lens 2: Owner Myth

What does leadership believe is happening?

Lens 3: Design Lever

What specific change closes the gap?

Lens 4: Failure Point

How does the programme die at this stage if you don't fix it?

Let's walk through three critical stages where most programmes leak:

Your partner heard about the programme from a dealer, a WhatsApp forward, or a peer electrician. But here's the problem.

Your partner filled out the form. The app downloaded. Their name now appears on your dashboard. Leadership celebrates this as a win.

Your partner has figured out how to scan invoices. Points are posting. They're getting cashback. The programme is working.

But here's the catch.

Each stage has a specific gap between what leadership believes and what's actually happening. Most programmes invest in launch campaigns (Unseen → Noticed) and assume the rest happens automatically. It doesn't.

The biggest leaks happen between stages two and four. Onboarded partners never take their first action. Earning partners have zero loyalty beyond cashback.

The programmes winning at activation have identified their specific leak and fixed it surgically instead of throwing more budget at campaigns.

Your diagnostic question: Which stage is your biggest leak? Where is the gap between Partner Reality and Owner Myth largest in your programme?

That's where you start.

Most organizations treat loyalty programs as a single project with a launch date and a big enrollment target. The loyalty activation framework replaces that mindset with a journey view. It forces stage specific diagnosis instead of one generic engagement issue.

This is the activation methodology for trade programs that actually works.

Once you have identified your biggest gaps, the Campaign Architecture Mapper tells you exactly what to build. This is your reward optimization strategy at each stage.

<Add in framework here>

What most brands do wrong is create one size fits all launch campaigns. They invest heavily at launch and zero in habit building. Their assets are generic and do not speak to specific personas like electrician versus retailer versus contractor.

What works is stage specific campaigns with persona led assets. Asian Paints, Castrol, and Greenpanel succeeded because they built different creative for Unseen→Noticed (FOMO) versus Earning→Belonging (status). They used movement style narratives, not "loyalty program" but "career accelerator" or "professional community." They maintained always on rhythm with monthly engagement, not quarterly bursts.

Understanding activation theory is valuable. Seeing activation work at scale in real companies is transformative because it proves the approach is not aspirational but practical.

Castrol entered the mechanic loyalty space with a specific insight. The mechanic loyalty problem was not about lack of rewards or complexity of mechanics. The problem was cash flow. Most loyalty schemes operated on sixty to ninety day payment cycles. A mechanic who earned ₹1,000 in January would not see the money in his account until March. This payment delay created a fundamental activation problem. The mechanic could not believe the system delivered real value because the value took months to materialize.

Castrol partnered with Standard Chartered Bank and built FastScan with instant IMPS transfers. When a mechanic scanned an invoice in the morning, the points hit his bank account by evening. The activation shifted from "I will earn money eventually" to "I earned money today." This single change transformed the entire program dynamic.

In the first eighteen months, Castrol enrolled 150,000 mechanics and retailers on the platform. Average daily transactions exceeded 100,000 with ₹6 crores reimbursed every month. The program achieved these metrics not because the rewards were larger than competitors, but because the immediate payment solved the real constraint that prevented activation.

The lesson from Castrol is very important: activation works when you figure out the real problem that is keeping people from getting involved, not when you make the incentive look good on paper.

Asian Paints asked a radical question about trade loyalty: what if the program itself made money for the partner instead of giving them rewards for taking part? They built the Colour Academy to give partners training that they could sell right away instead of giving them points for purchases or cash back.

The program in 2019 taught 156,000 painters in 18 Indian states about color theory, how to prepare surfaces, how to apply paint, and how to design things that look good. Painters who finished the training could show customers that they were better than painters who hadn't. This knowledge set them apart from the competition. A painter who had finished their training at the academy could charge ₹400 per day, while an untrained painter could only charge ₹250. Because of the difference in pay, painters who went to the academy could make 40% to 60% more.

The Colour Academy's activation metrics were eight times higher than the industry average. The program got forty percent of people to participate in eighteen regions, while the industry standard for loyalty programs was only five percent. Why? The program got partners to work together by making them more valuable to the company, not by giving them outside rewards. Painters had a clear, short-term financial reason to get involved.

Asian Paints taught us that activation works when the program is useful to the partner's business, not when the program offers useful rewards in addition to the main transaction.

Greenpanel approached trade loyalty with a specific philosophy: carpenters and contractors are professionals, and they should be treated like valued business partners, not transaction processors. This mindset changed everything about how Greenpanel designed their activation strategy.

When Greenpanel launched the Mitr app, they made specific choices that communicated respect. The app was built in six regional languages because carpenters in different regions did not all speak English. Greenpanel established a dedicated toll free support line operational six days a week, staffed with people who understood carpenter challenges. Most importantly, Greenpanel invited over 200 carpenters to the Delhi launch event, treating them like community leaders rather than program participants.

The actual mechanics of Greenpanel Mitr were standard: QR code scanning, instant cashback, reward catalog. But the activation was different because the entire experience communicated respect for the carpenter's time, intelligence, and dignity. This respect became the emotional driver that moved carpenters from enrollment to action.

The lesson from Greenpanel: activation succeeds when you communicate that you respect your partners as professionals, not when you optimize rewards.

[Download Our Whitepaper ‘From Cashback To Community’, A Research-Grade White Paper on

Trade Influencer and Channel Partner Loyalty Transformation.]

Most manufacturers want a roadmap that shows exactly what to do at each stage. Here is the activation roadmap that separates programs that succeed from programs that decay by month four.

Before you can optimize activation, you must understand exactly where your program is leaking. Use the Ground Truth Framework to audit your current program across six stages: Unseen, Noticed, Onboarded, Earning, Belonging, Leading.

For each stage, measure two variables: Partner Reality (what partners actually experience) and Owner Myth (what leadership believes is happening). The gap between these two reveals your leaks.

You may discover that leadership believes fifty percent of partners have heard of the program, while ground research reveals only twenty percent are aware. You may learn that leadership believes signup is simple, while field testing shows the KYC form takes eighteen minutes on a low end Android phone and causes sixty percent abandonment.

This diagnostic phase requires field research, not dashboard analysis. Conduct interviews with fifty to one hundred trade partners who have enrolled but not activated. Ask why they stopped. Conduct interviews with fifty to one hundred trade partners who activated successfully. Ask what made the difference. Test your signup flow on actual low end devices with actual poor internet. Measure time to completion honestly.

Success metric for Month 1: You have identified your three biggest activation leaks and have specific hypotheses about what is causing them.

Based on your diagnosis, implement the highest impact quick wins that require minimal technical work.

Reduce KYC friction by moving to progressive profiling. This alone can move your signup to onboarded conversion from thirty percent to sixty percent without changing any other variable.

Implement the first win rule by offering a welcome bonus or first action multiplier that hits the partner's wallet within twenty four hours. This moves your first action completion rate from twenty five percent to fifty percent plus almost immediately.

Segment your audience by persona and redesign communications. Create separate messaging for electricians, painters, mechanics, retailers, and contractors. What resonates with a retailer (margin support, credit flexibility) will not resonate with a painter (skill development, status symbols). This segmentation can move your overall activation rate by ten to fifteen percentage points.

Activate the WhatsApp channel as your primary engagement touchpoint instead of relying solely on in app notifications or email. Trade partners check WhatsApp multiple times per hour but may not open an app they have not used before.

Success metric for Months 2-3: Your first action completion rate should move from below thirty percent to above fifty percent through these quick wins alone.

Now that you have improved the core activation funnel, your job is to sustain momentum as your user base grows.

Launch field activation events in three to five key regions where you have the highest concentration of channel partners. Invite dealers to host mini events where partners can experience the program in person. Create physical materials that dealers can display showing program benefits.

Train your distributor sales teams with specific pitch scripts, demo materials, and objection handling frameworks. If your sales team is not consistently pitching the program, adoption will plateau. Equip them to succeed.

Implement always on monthly content and weekly nudges. Create a content calendar showing what engagement drivers you are activating each month. January could be "safety focus" with relevant content for mechanics. February could be "skill development" with training modules for painters. Each month should have a clear theme that gives partners a reason to stay engaged.

Begin measuring and reporting activation metrics to senior leadership in language they understand. Show partner reality versus boardroom myth. Show your activation velocity (days to first action) instead of total enrollment. Show referral rates and retention curves instead of just raw member counts.

Success metric for Months 4-6: Your program should stabilize at fifty percent or higher monthly active engagement, with churn rates declining below fifteen percent monthly.

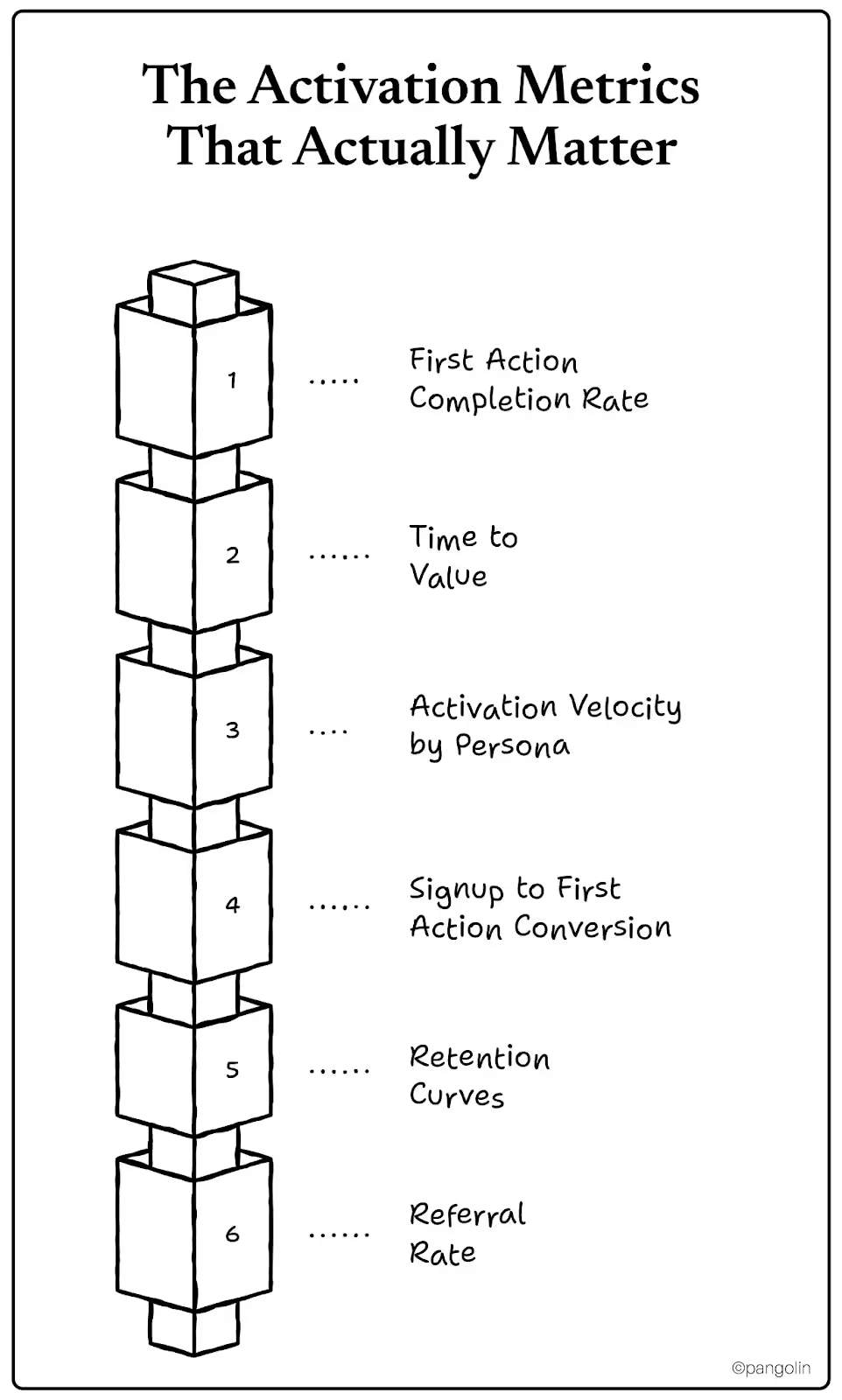

Most manufacturers track the wrong metrics for activation. They measure total members, monthly active users, and redemption rates. These are output metrics that hide what is actually happening. You need input metrics that show whether your activation strategy is working.

What percentage of onboarded partners take their first meaningful action within twenty four hours? Industry standard is below thirty percent. Healthy programs achieve sixty percent or higher. This metric reveals whether your first win mechanics are working.

How many days pass between signup and first action for your activated partners? Healthy programs target under twenty four hours. Most programs see seven to fifteen days. This metric reveals whether your activation experience is frictionless.

Different personas activate at different speeds. Electricians may activate faster than retailers. Mechanics may activate faster than contractors. Breaking this down by persona reveals where you are losing specific groups and where you should focus optimization.

Of all people who sign up, what percentage complete their first action? This is different from first action completion rate because it captures people who sign up but abandon before attempting first action. Healthy programs exceed sixty percent. Most programs are below thirty percent.

Of partners who activated in Month 1, what percentage are still active in Month 2, Month 3, Month 6? Most programs see sixty to seventy percent of Month 1 activated partners churn by Month 3. Programs with emotional loyalty drivers see seventy five percent plus retention.

What percentage of activated partners refer a new partner per quarter? Healthy programs exceed fifteen percent quarterly referral rate. Programs below five percent have not achieved emotional loyalty.

These metrics should be your north star metrics, tracked weekly, analyzed for trends, and reported to leadership as health indicators of your program.

[Download the Ground Truth Framework Worksheet to diagnose your activation gaps]

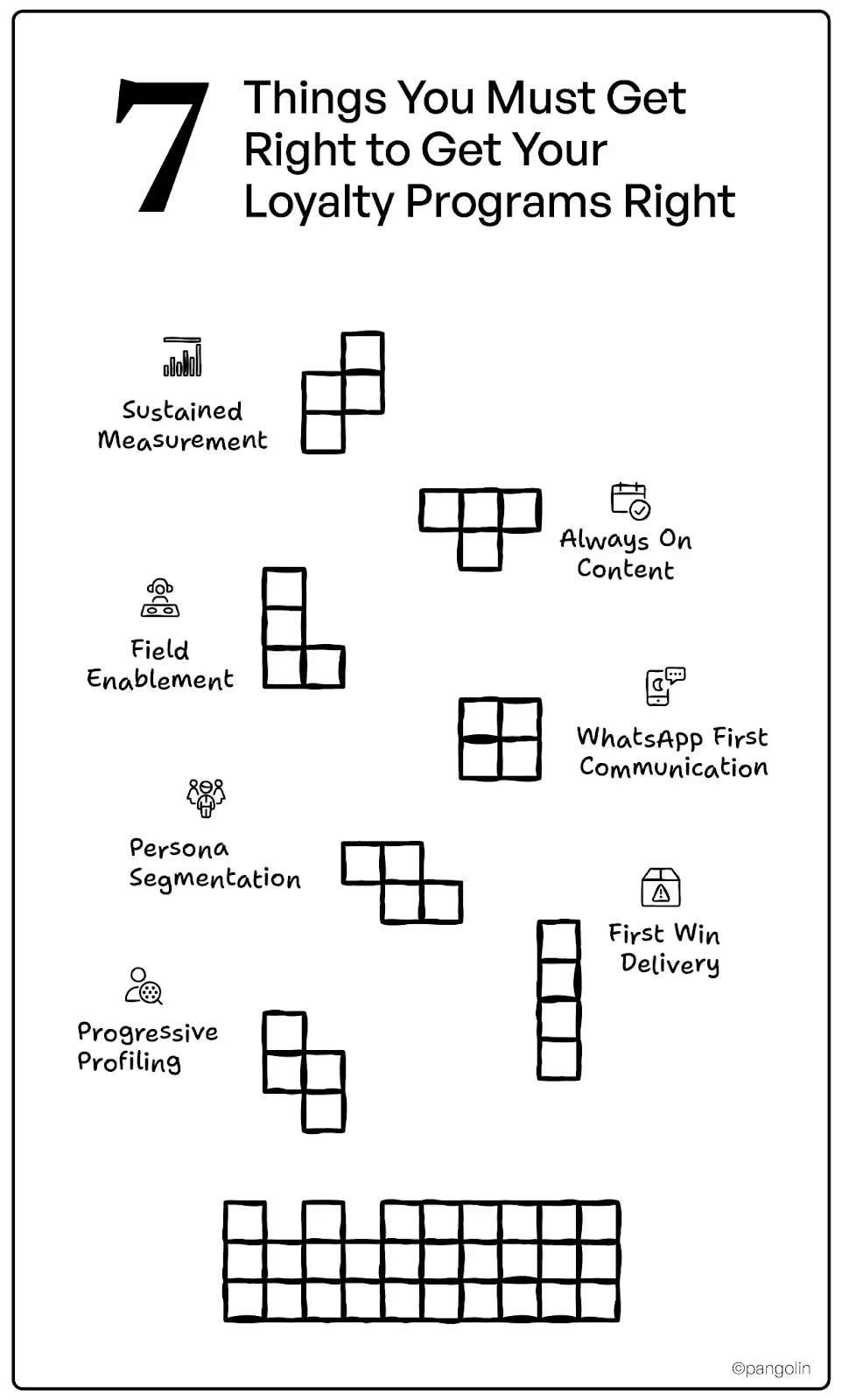

As you design or redesign your activation strategy, ensure you are addressing these seven critical elements that separate programs that activate successfully from programs that leak partners.

If you cannot answer "yes" to all seven, your activation strategy has critical gaps.

After auditing dozens of trade loyalty programs across India, the Middle East, and Southeast Asia, one pattern emerges repeatedly. The best performing programs are the ones where leadership has stopped treating activation as a marketing problem and started treating it as a business architecture problem.

When you stop asking "How do we get more enrollments?" and start asking "What is preventing our partners from taking action?", everything changes. You begin asking partners directly why they stopped after signup. You field test your signup flow on actual devices with actual connectivity. You discover that the partner's real constraint is not reward size but instant proof. You learn that the partner's primary communication channel is WhatsApp, not email. You understand that respect for the partner's time matters as much as the reward offered.

This is the activation truth that changes programs from leaking to thriving. Activation is not a marketing problem. It is a fundamental alignment problem between what your program offers and what your partners actually need.

Your Monu exists somewhere in your channel right now. An electrician with dreams, a painter seeking respect, a mechanic wanting security. The question is whether you have done the work to understand what activation actually requires in your context and whether you have the discipline to build it right.

You have reached the end of this guide, but this is actually where your work begins. Understanding activation intellectually is different from building it operationally.

Here is what you should do:

This week: Audit your current activation metrics. Pull your first action completion rate, time to value, and signup to first action conversion. Be honest about where you are leaking. Compare your numbers to the benchmarks in this guide.

Next week: Conduct field research. Interview twenty to thirty partners who enrolled but never activated. Ask specifically why they stopped. You will discover patterns. You will learn the real barriers, not the assumed barriers.

Within 30 days: Use the Ground Truth Framework diagnostic to identify your three biggest activation leaks. Be specific about what is happening at each stage and what hypothesis you have about what is causing it.

Within 90 days: Implement the quick wins outlined in Months 2-3 of this roadmap. Reduce KYC friction. Implement the first win rule. Segment by persona. Activate WhatsApp as a primary channel. Measure the difference.

The manufacturers winning at trade loyalty activation in 2024 and 2025 have all made the shift from campaign to operating model. They staff permanent teams. They invest in ground presence. They measure differently. They optimize based on what they learn from the ground, not what looks good on a dashboard.

Your loyalty program has thirty thousand members but only eight thousand are active. The Loyalty Activation Framework finds the other twenty two thousand and brings them back.

The brands that win loyalty will win everything else.

Book a Consultation with Pangolin Marketing to discuss your specific activation challenges and get a customized diagnosis of your program's gaps. The manufacturers winning at trade loyalty are not the ones with the biggest budgets. They are the ones who understood their Ground Truth first.

Aniket leads content marketing at Pangolin, writing and editing for B2B tech clients who need sharp messaging and consistent output. He came from journalism and brings that newsroom discipline to content work, turning drafts around quickly and keeping quality high.